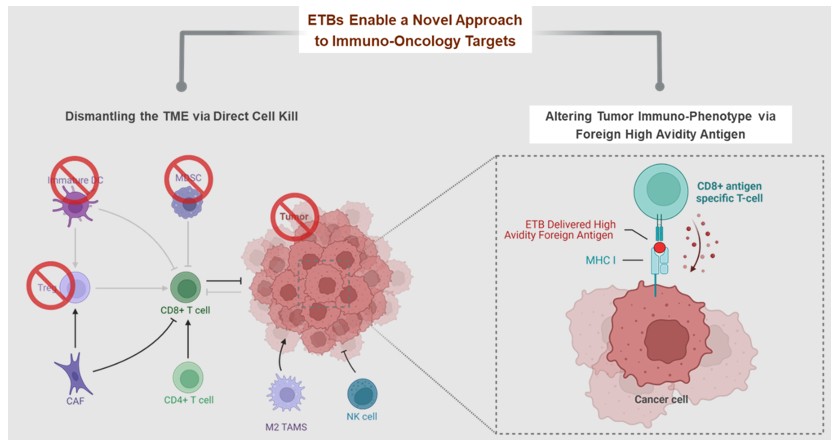

unique and leverages the intrinsic intracellular routing properties of ETBs through a mechanism we call Antigen Seeding.

Immuno-Oncology ETBs

MT-6402 – ETB Targeting PD-L1

We filed an Investigational New Drug (“IND”) application for MT-6402, our ETB targeting PD-L1, in December 2020 and the IND was accepted in January 2021. A Phase I study of MT-6402 in relapsed/refractory patients with PD-L1 expressing tumors began in July 2021 at a starting dose of 16 mcg/kg. The Phase I study for MT-6402 is a multi-center, open-label, dose escalation and dose expansion trial. Patients with confirmed PD-L1 expressing tumors or confirmed PD-L1 expression in the TME are eligible for enrollment, irrespective of HLA genotype or CMV status. Following a review of the safety data from cohort 6 (83 mcg/kg), which was well tolerated, patient enrollment in cohort 7 initiated. In November 2021, MT-6402 was granted Fast Track designation for the treatment of patients with advanced with non-small cell lung cancer (“NSCLC”) NSCLC expressing PD-L1. For MT-6402, dose escalation in the Phase I study continues as planned for 2023, with one expansion for patients with high PD-L1 tumor expression (≥ 50%) and the other expansion for patients with low (1 - 49%) PD-L1 tumor expression.

As of June 2023, patients have been treated across seven dose escalation cohorts of 16 mcg/kg, 24 mcg/kg, 32 mcg/kg, 42 mcg/kg, 63 mcg/kg, 83 mcg/kg and 100 mcg/kg in the MT-6402 study of patients with relapsed/refractory tumors that express PD-L1. We continue to observe pharmacodynamic (“PD”) effects including the depletion of PD-L1+ monocytes, MDSCs, PD-L1+ dendritic cells, as well as T cell activation.

One patient with high tumor PD-L1 expression who also had Antigen Seeding capability, demonstrated tumor regression while being dosed with MT-6402 for over 7 months. This patient, with NSCLC, was treated in cohort 1 (16 mcg/kg) and demonstrated resolution of three osseous lesions and a reduction in uptake in the remaining lesion. This patient also experienced grade 2 cytokine release syndrome (“CRS”) consistent with T-cell activation and was dose reduced to 8 mcg/kg. This patient had evaluable-only multiple sites of bone disease that appeared to have resolved on bone scan after 3 - 4 months on MT-6402 with only one remaining site which showed decreased uptake.

28