Molecular Templates, Inc.

2022 Proxy Statement and

Notice of Annual Meeting of Stockholders

to be held on June 3, 2022

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Under Rule 14a-12

Molecular Templates, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee paid previously with preliminary materials.

[ ] Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

Molecular Templates, Inc.

2022 Proxy Statement and

Notice of Annual Meeting of Stockholders

to be held on June 3, 2022

|

April 27, 2022

To Our Stockholders:

You are cordially invited to attend the 2022 annual meeting of stockholders of Molecular Templates, Inc. to be held at 10:00 a.m. Eastern Time on Friday, June 3, 2022 in a virtual meeting format. Due to the public health impact of the novel coronavirus outbreak (COVID-19) and to support the health and well-being of all Molecular Templates, Inc.’s people, including its management and stockholders, this year’s annual meeting will be conducted solely via live audio webcast on the Internet. Additionally, holding a virtual meeting enables greater stockholder attendance and participation from any location around the world, improves meeting efficiency and our ability to communicate effectively with our stockholders, and reduces the cost and environmental impact of our annual meeting. In order to attend, you must register prior to the deadline of June 1, 2022 at 5:00 p.m. Eastern Time at www.proxydocs.com/MTEM. Upon completing your registration, you will receive further instructions via email, including your unique links that will allow you access to the annual meeting and will permit you to submit questions. You will not be able to attend the annual meeting in person. Additional details regarding the meeting, the business to be conducted at the meeting, and information about Molecular Templates, Inc. that you should consider when you vote your shares are described in this proxy statement. |

|

At the annual meeting, three persons will be elected to our Board of Directors. In addition, we will ask stockholders to ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending 2022, and to approve by an advisory vote the compensation of our named executive officers, as disclosed in this proxy statement. The Board of Directors recommends the approval of each of these proposals as set forth in this proxy statement. Such other business will be transacted as may properly come before the annual meeting.

We hope you will be able to attend the annual meeting virtually via the Internet. Whether you plan to attend the annual meeting virtually or not, it is important that you cast your vote either at the time of the meeting or by proxy. You may vote over the Internet as well as by telephone or by mail. When you have finished reading this proxy statement, you are urged to vote in accordance with the instructions set forth in this proxy statement. We encourage you to vote promptly by proxy so that your shares will be represented and voted at the virtual meeting, whether or not you can attend.

Thank you for your continued support of Molecular Templates, Inc. We look forward to seeing you at the annual meeting.

Sincerely,

Eric E. Poma, Ph.D.

Chief Executive Officer and Chief Scientific Officer

MOLECULAR TEMPLATES, INC.

9301 Amberglen Blvd., Suite 100

Austin, TX 78729

(512) 869-1555

April 27, 2022

Notice of 2022 Annual Meeting of Stockholders

TIME: 10:00 a.m. Eastern Time

DATE: Friday, June 3, 2022

PLACE: Annual Meeting to be held live via the Internet – please visit www.proxydocs.com/MTEM for more details*

PURPOSES:

| 1. | To elect three directors to serve three-year terms expiring in 2025; |

| 2. | To ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending 2022; |

| 3. | To approve, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed in the accompanying proxy statement; and |

| 4. | To transact such other business that is properly presented at the annual meeting and any adjournments or postponements thereof. |

| * | In light of the COVID-19 pandemic, for the safety of all of our people, including our management and stockholders, we have determined that the annual meeting will be held in a virtual meeting format only, via the Internet, with no physical in-person meeting. In order to attend, you must register prior to the deadline of June 1, 2022 at 5:00 p.m. Eastern Time at www.proxydocs.com/MTEM and enter the control number included in the proxy card that you receive. Upon completing your registration, you will receive further instructions via email, including your unique links that will allow you access to the annual meeting and will permit you to submit questions. |

WHO MAY VOTE:

You may vote if you were the record owner of Molecular Templates, Inc. common stock at the close of business on April 7, 2022.

A list of stockholders of record will be available virtually during the annual meeting and, during the 10 days prior to the annual meeting, at our principal executive offices located at 9301 Amberglen Blvd., Suite 100, Austin, TX 78729.

All stockholders are cordially invited to attend the annual meeting virtually via the Internet. To participate in the annual meeting virtually via the Internet, please visit www.proxydocs.com/MTEM. In order to attend, you must register in advance at www.proxydocs.com/MTEM prior to the deadline of June 1, 2022 at 5:00 p.m. Eastern Time. Upon completing your registration, you will receive further instructions via email, including your unique links that will allow you access to the meeting and to submit questions during the meeting. You will not be able to attend the annual meeting in person. Whether you plan to attend the annual meeting virtually or not, we urge you to vote and submit your proxy by the Internet, telephone or mail in order to ensure the presence of a quorum. You may change or revoke your proxy at any time before it is voted at the annual meeting.

BY ORDER OF THE BOARD OF DIRECTORS

Megan C. Filoon

General Counsel and Secretary

| 3 | ||||

| Security Ownership of Certain Beneficial Owners and Management |

7 | |||

| 10 | ||||

| 10 | ||||

| 11 | ||||

| 12 | ||||

| 15 | ||||

| 16 | ||||

| 20 | ||||

| 20 | ||||

| 20 | ||||

| 20 | ||||

| 21 | ||||

| 22 | ||||

| 23 | ||||

| 23 | ||||

| 23 | ||||

| 25 | ||||

| 26 | ||||

| 28 | ||||

| 29 | ||||

| 29 | ||||

| 31 | ||||

| 32 | ||||

| 33 | ||||

| 33 | ||||

| 34 | ||||

| Proposal No. 2 Ratification of Appointment of Independent Registered Public Accounting Firm |

35 | |||

| 35 | ||||

| 37 | ||||

| 38 | ||||

| 38 | ||||

| 38 | ||||

MOLECULAR TEMPLATES, INC.

9301 Amberglen Blvd., Suite 100

Austin, Texas 78729

(512) 869-1555

Proxy Statement for Molecular Templates, Inc. 2022 Annual Meeting of Stockholders to be

Held on June 3, 2022

This proxy statement, along with the accompanying Notice of 2022 Annual Meeting of Stockholders (the “Notice”), contains information about the 2022 annual meeting of stockholders of Molecular Templates, Inc., including any adjournments or postponements of the annual meeting. We are holding the annual meeting at 10:00 a.m. Eastern Time on Friday, June 3, 2022 in a virtual format only.

In light of the COVID-19 pandemic, for the safety of all of our people, including our management and stockholders, we have determined that the annual meeting will be held in a virtual meeting format only, via the Internet, with no physical in-person meeting. You will be able to attend and participate in the annual meeting online by visiting www.proxydocs.com/MTEM. In order to attend, you must register in advance at www.proxydocs.com/MTEM prior to the deadline of June 1, 2022 at 5:00 p.m. Eastern Time and enter the control number included in the proxy card that you receive. Upon completing your registration, you will receive further instructions via email, including your unique links that will allow you access to the meeting and will permit you to submit questions.

In this proxy statement, we refer to Molecular Templates, Inc. as “MTEM,” “the Company,” “we” and “us.”

This proxy statement relates to the solicitation of proxies by our Board of Directors (the “Board” or the “Board of Directors”) for use at the annual meeting.

On or about April 27, 2022, we began sending this proxy statement, the attached Notice and the enclosed proxy card to all stockholders entitled to vote at the annual meeting.

Although not part of this proxy statement, we are also sending, along with this proxy statement, our Annual Report on Form 10-K, which includes our financial statements, for the fiscal year ended December 31, 2021.

Explanatory Note

On August 1, 2017, Molecular Templates, Inc. (“Public Molecular”), formerly known as Threshold Pharmaceuticals, Inc. (“Threshold”), completed its business combination with Molecular Templates OpCo, Inc., or what was then known as “Molecular Templates, Inc.” (“Private Molecular”), in accordance with the terms of the Agreement and Plan of Merger and Reorganization, dated as of March 16, 2017, by and among Molecular, Trojan Merger Sub, Inc. (“Merger Sub”), our wholly owned subsidiary, and Private Molecular, pursuant to which Merger Sub merged with and into Private Molecular, with Private Molecular surviving as our wholly owned subsidiary, now known as “Molecular Templates OpCo, Inc.” (the “Merger”).

In this proxy statement, unless the context specifically indicates otherwise, “the Company”, “we”, “us”, “our” and “Molecular” refer to Public Molecular and its subsidiaries following the Merger, effective on August 1, 2017, and to Private Molecular and its subsidiaries prior to the Merger. References to “Pre-Merger Threshold” means Threshold prior to the Merger effective on August 1, 2017.

| Molecular Templates, Inc. | 2022 Proxy Statement | 1 |

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to

be Held on Friday, June 3, 2022 at 10:00 a.m.

Eastern Time

This proxy statement, the Notice and our 2021 annual report to stockholders are available electronically for viewing, printing and downloading at www.proxydocs.com/MTEM. To view these materials please have your control number(s) available that appears on your proxy card. On this website, you can also elect to receive future distributions of our proxy statements and annual reports to stockholders by electronic delivery.

Additionally, you can find a copy of our Annual Report on Form 10-K, which includes our financial statements, for the fiscal year ended December 31, 2021 on the website of the Securities and Exchange Commission, or the SEC, at www.sec.gov, or in the “SEC Filings” section of the “Investors” section of our website at www.mtem.com. You may also obtain a printed copy of our Annual Report on Form 10-K, including our financial statements, free of charge, from us by sending a written request to: Secretary, Molecular Templates, Inc., 9301 Amberglen Blvd., Suite 100, Austin, Texas 78729. Exhibits will be provided upon written request and payment of an appropriate processing fee.

| 2 | Molecular Templates, Inc. | 2022 Proxy Statement |

Important Information About the Annual Meeting

and Voting

Why is the Company Soliciting My Proxy?

The Board is soliciting your proxy to vote at the 2022 annual meeting of stockholders to be held in a virtual meeting format on Friday, June 3, 2022, at 10:00 a.m. Eastern Time and any adjournments of the meeting, which we refer to as the annual meeting. This proxy statement along with the accompanying Notice summarizes the purposes of the meeting and the information you need to know to vote at the annual meeting.

We have sent you this proxy statement, the Notice, the proxy card and a copy of our Annual Report on Form 10-K for the fiscal year ended 2021 because you owned shares of our common stock on the record date. We intend to commence distribution of the proxy materials to stockholders on or about April 27, 2022.

How Do I Attend the Annual Meeting?

In light of the COVID-19 pandemic, for the safety of all of our people, including our management and stockholders, we have determined that the annual meeting will be held in a virtual meeting format only, via the Internet, with no physical in-person meeting. The annual meeting will be held via live webcast on Friday, June 3, 2022, starting at 10:00 a.m. Eastern Time. Stockholders may attend the annual meeting by registering at www.proxydocs.com/MTEM. Stockholders may vote and submit questions while connected to the annual meeting. You need not attend the annual meeting in order to vote.

In order to attend the annual meeting, you must register in advance at www.proxydocs.com/MTEM prior to the deadline of June 1, 2022 at 5:00 p.m. Eastern Time. Upon completing your registration, you will receive further instructions via email, including your unique link that will allow you to access the annual meeting, vote online during the annual meeting and will permit you to submit questions during the annual meeting. You will also be permitted to submit questions at the time of registration. You may ask questions that are confined to matters properly presented at the annual meeting and of general Company concern.

The annual meeting will begin promptly at 10:00 a.m. Eastern Time. We encourage you to access the annual meeting prior to the start time. Online access will open approximately at 9:45 a.m. Eastern Time, and you should allow ample time to log in to the meeting and test your computer audio system. We recommend that you carefully review the procedures needed to gain admission in advance.

What Happens if There Are Technical Difficulties during the Annual Meeting?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual annual meeting, voting at the annual meeting or submitting questions at the annual meeting. If you encounter any difficulties accessing the virtual annual meeting during the check-in or meeting time, please call the technical support number that will be provided in the instruction email containing your unique link for the annual meeting.

Who May Vote?

Only stockholders of record at the close of business on April 7, 2022 are entitled to vote at the annual meeting. On this record date, there were 56,305,049 shares of our common stock outstanding and entitled to vote. Our common stock is our only class of voting stock. Our Series A Convertible Preferred Stock does not have any voting rights.

If on April 7, 2022 your shares of our common stock were registered directly in your name with our transfer agent, Computershare Trust Company, N.A., then you are a stockholder of record.

If on April 7, 2022 your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice is being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the annual meeting. If you want to vote in person at the virtual annual meeting, you must register at www.proxydocs.com/MTEM prior to the deadline of June 1, 2022 at 5:00 p.m. Eastern Time. You may be instructed to obtain a legal proxy from your broker, bank or other nominee and to submit a copy in advance of the meeting. Further instructions will be provided to you as part of your registration process. You do not need to attend the annual meeting to vote your

shares. Shares represented by valid proxies, received in time for the annual meeting and not revoked prior to the annual meeting, will be voted at the annual meeting. For instructions on how to change or revoke your proxy, see “May I Change or Revoke My Proxy?” below.

How Many Votes Do I Have?

Each share of our common stock that you own entitles you to one vote.

| Molecular Templates, Inc. | 2022 Proxy Statement | 3 |

Important Information About the Annual Meeting and Voting

How Do I Vote?

Whether you plan to attend the online annual meeting or not, we urge you to vote by proxy. All shares represented by valid proxies that we receive through this solicitation, and that are not revoked, will be voted in accordance with your instructions on the proxy card or as instructed via Internet or telephone. You may specify whether your shares should be voted for, against or abstain for each nominee for director, and whether your shares should be voted for, against or abstain with respect to each of the other proposals. If you properly submit a proxy without giving specific voting instructions, your shares will be voted in accordance with the Board’s recommendations as noted below. Voting by proxy will not affect your right to attend the annual meeting. If your shares are registered directly in your name through our stock transfer agent, Computershare Trust Company, N.A., or you have stock certificates registered in your name, you may vote:

| • | By Internet or by telephone. Follow the instructions on the proxy card to vote by Internet or telephone. |

| • | By mail. If you received a proxy card by mail, you can vote by mail by completing, signing, dating and returning the proxy card as instructed on the card. If you sign the proxy card but do not specify how you want your shares voted, they will be voted in accordance with the Board’s recommendations as noted below. |

| • | During the meeting. To vote during the live webcast of the annual meeting, you must first register at www.proxydocs.com/MTEM. Upon completing your registration, you will receive further instructions via email, including your unique link that will allow you access to the annual meeting and to submit questions during the annual meeting. Please be sure to follow instructions found on your proxy card and subsequent instructions that will be delivered to you via email. |

Telephone and Internet voting facilities for stockholders of record will be available 24 hours a day and will close at 10:00 a.m. Eastern Time on June 3, 2022.

If your shares are held in “street name” (held in the name of a bank, broker or other holder of record), you will receive instructions from the holder of record. You must follow the instructions of the holder of record in order for your shares to be voted. Telephone and Internet voting also will be offered to stockholders owning shares through certain banks and brokers. If your shares are not registered in your own name and you plan to vote your shares virtually at the annual meeting, you must register at www.proxydocs.com/MTEM prior to the deadline of June 1, 2022 at 5:00 p.m. Eastern Time. You may be instructed to obtain a legal proxy from your broker, bank or other nominee and to submit a copy in advance of the meeting. Further instructions will be provided to you as part of your registration process.

How Does the Board of Directors Recommend That I Vote on the Proposals?

The Board of Directors recommends that you vote as follows:

| • | “FOR” the election of the nominees for director; |

| • | “FOR” the ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022; and |

| • | “FOR” the compensation of our named executive officers, as disclosed in this proxy statement. |

If any other matter is presented at the annual meeting, your proxy provides that your shares will be voted by the proxy holder listed in the proxy in accordance with his best judgment. At the time this proxy statement was first made available, we knew of no matters that needed to be acted on at the annual meeting, other than those discussed in this proxy statement. None of our directors have any substantial interest in any matter to be acted upon except with respect to the directors so nominated. None of our Named Executive Officers have any substantial interest in any matter to be acted on other than Proposal No. 3.

May I Change or Revoke My Proxy?

If you give us your proxy, you may change or revoke it at any time before the annual meeting. You may change or revoke your proxy in any one of the following ways:

| • | if you received a proxy card, by signing a new proxy card with a date later than your previously delivered proxy and submitting it as instructed above; |

| • | by re-voting by Internet or by telephone as instructed above; |

| 4 | Molecular Templates, Inc. | 2022 Proxy Statement |

Important Information About the Annual Meeting and Voting

| • | by notifying Molecular Templates, Inc.’s Secretary in writing before the annual meeting that you have revoked your proxy; or |

| • | by attending the virtual annual meeting and voting at the meeting. Attending the annual meeting webcast will not in and of itself revoke a previously submitted proxy. You must specifically request at the annual meeting that it be revoked. |

Your most current vote, whether by telephone, Internet or proxy card is the one that will be counted.

What if I Receive More Than One Proxy Card?

You may receive more than one proxy card if you hold shares of our common stock in more than one account, which may be in registered form or held in street name. Please vote in the manner described above under “How Do I Vote?” for each account to ensure that all of your shares are voted.

Will My Shares be Voted if I Do Not Vote?

If your shares are registered in your name or if you have stock certificates, they will not be counted if you do not vote as described above under “How Do I Vote?” If your shares are held in street name and you do not provide voting instructions to the bank, broker or other nominee that holds your shares as described above, the bank, broker or other nominee that holds your shares has the authority to vote your unvoted shares only on certain of the proposals set forth in this proxy statement without receiving instructions from you. Therefore, we encourage you to provide voting instructions to your bank, broker or other nominee. This ensures your shares will be voted at the annual meeting and in the manner you desire. A “broker non-vote” will occur if your broker cannot vote your shares on a particular matter because it has not received instructions from you and does not have discretionary voting authority on that matter.

What Vote is Required to Approve Each Proposal and How are Votes Counted?

| Proposal 1: Elect Directors |

The affirmative vote of a majority of the votes cast affirmatively or negatively at the annual meeting is required to elect directors. Abstentions will have no effect on the results of this vote. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. | |

| Proposal 2: Ratify Appointment of Independent Registered Public Accounting Firm |

The affirmative vote of a majority of shares present in person or represented by proxy at the meeting and entitled to vote thereon at the annual meeting is required to ratify the selection of our independent registered public accounting firm. Abstentions will be treated as votes against this proposal. Brokerage firms have authority to vote customers’ unvoted shares held by the firms in street name on this proposal and therefore there will be no broker non-votes on this proposal. We are not required to obtain the approval of our stockholders to select our independent registered public accounting firm. However, if our stockholders do not ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2022, the Audit Committee of our Board of Directors will reconsider its selection. | |

| Proposal 3: Approve an Advisory Vote on the Compensation of our Named Executive Officers |

The affirmative vote of a majority of shares present in person or represented by proxy at the meeting and entitled to vote thereon at the annual meeting is required to approve, on an advisory basis, the compensation of our named executive officers, as described in this proxy statement. Abstentions will be treated as votes against this proposal. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. Although the advisory vote is non-binding, the Compensation Committee and the Board of Directors will review the voting results and take them into consideration when making future decisions regarding executive compensation. |

| Molecular Templates, Inc. | 2022 Proxy Statement | 5 |

Important Information About the Annual Meeting and Voting

Is Voting Confidential?

We will keep all the proxies, ballots and voting tabulations private. We only let our Inspector of Election, a representative of Mediant Communications, Inc. and our transfer agent, Computershare Trust Company, N.A., examine these documents. Management will not know how you voted on a specific proposal unless it is necessary to meet legal requirements. We will, however, forward to management any written comments you make, on the proxy card or otherwise provide.

Where Can I Find the Voting Results of the Annual Meeting?

The preliminary voting results will be announced at the annual meeting, and we will publish preliminary, or final results if available, in a Current Report on Form 8-K within four business days of the annual meeting. If final results are unavailable at the time we file the Form 8-K, then we will file an amended report on Form 8-K to disclose the final voting results within four business days after the final voting results are known.

What Are the Costs of Soliciting these Proxies?

We will pay all of the costs of soliciting these proxies. Our directors and employees may solicit proxies in person or by telephone, fax or email. We will pay these employees and directors no additional compensation for these services. We will ask banks, brokers and other institutions, nominees and fiduciaries to forward these proxy materials to their principals and to obtain authority to execute proxies. We will then reimburse them for their expenses.

What Constitutes a Quorum for the Annual Meeting?

The presence, in person or by proxy, of the holders of a majority of the voting power of all outstanding shares of our common stock entitled to vote at the annual meeting is necessary to constitute a quorum at the annual meeting. Votes of stockholders of record who are present virtually at the annual meeting, abstentions, and broker non-votes are counted for purposes of determining whether a quorum exists.

Householding of Annual Disclosure Documents

SEC rules concerning the delivery of annual disclosure documents allow us or your broker to send a single Notice or, if applicable, a single set of our proxy materials to any household at which two or more of our stockholders reside, if we or your broker believe that the stockholders are members of the same family. This practice, referred to as “householding,” benefits both you and us. It reduces the volume of duplicate information received at your household and helps to reduce our expenses. The rule applies to our Notices, annual reports, proxy statements and information statements. Once you receive notice from your broker or from us that communications to your address will be “householded,” the practice will continue until you are otherwise notified or until you revoke your consent to the practice. Stockholders who participate in householding will continue to have access to and utilize separate proxy voting instructions.

If your household received a single Notice or, if applicable, a single set of proxy materials this year, but you would prefer to receive your own copy, please contact our transfer agent, Computershare Trust Company, N.A., by calling their toll-free number 1-888-451-0183.

If you do not wish to participate in “householding” and would like to receive your own Notice or, if applicable, set of Molecular Templates, Inc.’s proxy materials in future years, follow the instructions described below. Conversely, if you share an address with another Molecular Templates, Inc. stockholder and together both of you would like to receive only a single Notice or, if applicable, set of proxy materials, follow these instructions:

| • | If your Molecular Templates, Inc. shares are registered in your own name, please contact our transfer agent, Computershare Trust Company, N.A., and inform them of your request by calling them at 1-888-451-0183 or writing them at PO BOX 505000, Louisville, KY 40233-5000. |

| • | If a broker or other nominee holds your Molecular Templates, Inc. shares, please contact the broker or other nominee directly and inform them of your request. Be sure to include your name, the name of your brokerage firm and your account number. |

| 6 | Molecular Templates, Inc. | 2022 Proxy Statement |

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information with respect to the beneficial ownership of our common stock as of April 7, 2022 for:

| • | the executive officers named in the Summary Compensation Table on page 23 of this proxy statement, |

| • | each of our directors and director nominees, |

| • | all of our current directors and executive officers as a group, and |

| • | each stockholder known by us to own beneficially more than 5% of our common stock. |

Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to the securities. We deem shares of common stock that may be acquired by an individual or group within 60 days of April 7, 2022 pursuant to the conversion of our Series A Preferred Stock and exercise of options or warrants, each to the extent applicable, to be outstanding for the purpose of computing the percentage ownership of such individual or group but are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person shown in the table. Each share of our common stock is entitled to one vote on each matter considered at the Annual Meeting and shares of our Series A Preferred Stock do not have any voting rights, unless converted into common stock. Except as indicated in footnotes to this table, we believe that the stockholders named in this table have sole voting and investment power with respect to all shares of common stock shown to be beneficially owned by them based on information provided to us by these stockholders. Percentage of ownership is based on 56,305,049 shares of common stock outstanding on April 7, 2022.

| Name and Address of Beneficial Owner** |

Shares Beneficially Owned |

|||||||

| Number | Percent | |||||||

| Five Percent Stockholders: |

||||||||

| Biotech Target N.V. (1) Ara Hill Top Building Unit A-5 Pletterijwg Oost 1, Curacao |

10,992,003 | 19.5 | % | |||||

| Entities affiliated with SHV Management Services LLC (2) c/o Santé Ventures 201 West 5th Street, Suite 1500 Austin, Texas 78701 |

7,036,100 | 12.5 | % | |||||

| Longitude Venture Partners III, L.P. (3) 2740 Sand Hill Road, 2nd Floor Menlo Park, CA 94025 |

4,647,302 | 8.0 | % | |||||

| BVF Partners, L.P. (4) 44 Montgomery St., 40th Floor San Francisco, CA 94104 |

3,379,599 | 6.0 | % | |||||

| Pictet Asset Management SA (5) 60 Route des Acacias Geneva 73 V8 1211 Switzerland |

3,301,019 | 5.9 | % | |||||

| Molecular Templates, Inc. | 2022 Proxy Statement | 7 |

Security Ownership of Certain Beneficial Owners and Management

| Name and Address of Beneficial Owner** |

Shares Beneficially Owned |

|||||||

| Number | Percent | |||||||

| Named Executive Officers and Directors: |

||||||||

| Eric E. Poma, Ph.D. (6) |

1,830,957 | 3.2 | % | |||||

| Jason S. Kim (7) |

736,285 | 1.3 | % | |||||

| Roger J. Waltzman (8) |

248,749 | * | ||||||

| David Hirsch, M.D. Ph.D. (9) |

4,732,302 | 8.2 | % | |||||

| David R. Hoffmann (10) |

93,635 | * | ||||||

| Kevin Lalande (11) |

7,121,100 | 12.6 | % | |||||

| Jonathan Lanfear (12) |

15,000 | * | ||||||

| Scott Morenstein (13) |

2,369,991 | 4.2 | % | |||||

| Corsee Sanders, Ph.D. (14) |

55,000 | * | ||||||

| Harold E. Selick, Ph.D. (15) |

125,806 | * | ||||||

| Gabriela Gruia, M.D. |

— | — | ||||||

| All directors and current executive officers as a group (11 persons) (16) |

17,328,825 | 28.4 | % | |||||

| * | Represents beneficial ownership of less than 1% of the outstanding shares of our common stock. |

| ** | Unless otherwise indicated, the address of each beneficial owner listed in the table below is c/o Molecular Templates, Inc., 9301 Amberglen Blvd., Suite 100, Austin TX 78729. |

| (1) | This information is based solely on a Form 4 filed with the SEC on January 10, 2022. Consists of 10,992,003 shares of common stock held by Biotech Target N.V. BB Biotech AG is the sole stockholder of Biotech Target N.V. and may be deemed to share voting and investment power over our securities held by Biotech Target N.V. BB Biotech AG disclaims beneficial ownership of these securities except to the extent of its pecuniary interest therein. |

| (2) | This information is based solely on a Schedule 13D/A filed with the SEC on September 18, 2020. Consists of (i) 864,665 shares of common stock held by Santé Health Ventures I Annex Fund, L.P., (ii) 4,827 shares of common stock issuable upon exercise of warrants held by Santé Health Ventures I Annex Fund, L.P., (iii) 6,097,298 shares of common stock held by Santé Health Ventures I, L.P., (iv) 19,310 shares of common stock issuable upon exercise of warrants held by Santé Health Ventures I, L.P, and (v) 50,000 shares of common stock held by SHV Management Services, L.P. The securities held by Santé Health Ventures I Annex Fund, L.P. and Santé Health Ventures I, L.P. may be deemed to be beneficially owned by Kevin Lalande, a member of our Board, Joe Cunningham, M.D. and Douglas D. French, who are managing directors (the “SHV Directors”) of SHV Management Services, LLC (“SHV Management”). SHV Management is the general partner of SHV Annex Services, LP, which is the general partner of Santé Health Ventures I Annex Fund, L.P. SHV Management is also the general partner of SHV Management Services, LP, which is the general partner of Santé Health Ventures I, L.P. Each of the SHV Directors, SHV Management, SHV Annex Services, LP and SHV Management Services, LP disclaims beneficial ownership of these securities except to the extent of its or his pecuniary interest therein. |

| (3) | This information is based solely on a Schedule 13D/A filed with SEC on June 5, 2020. Consists of (i) 3,199,035 shares of common stock held by Longitude Venture Partners III, L.P. (“Longitude Venture III”) and (ii) 1,448,267 shares of common stock issuable upon exercise of warrants held by Longitude Venture III. Such securities are held by Longitude Venture III and may be deemed to be beneficially owned by Longitude Capital Partners III, LLC (“Longitude Capital III”), David Hirsch, Ph.D., a member of the Company’s Board, Patrick G. Enright, and Juliet Tammenoms Bakker. Longitude Capital III is the general partner of Longitude Venture III and may be deemed to share voting and investment power over our securities held by Longitude Venture III. Dr. Hirsch, Mr. Enright and Ms. Bakker are members of Longitude Capital III and Mr. Enright and Ms. Bakker are the managing members of Longitude Capital III, and all of them may be deemed to share voting and investment power over our securities held by Longitude Venture III. Each of Longitude Capital III, Dr. Hirsch, Mr. Enright and Ms. Bakker disclaims beneficial ownership of these securities except to the extent of its, his or her pecuniary interest therein. |

| (4) | This information is based solely on a Schedule 13G/A filed with the SEC on February 14, 2022. Consists of (i) 1,746,256 shares of common stock beneficially owned by Biotechnology Value Fund, L.P. (“BVF”), including 128,000 shares of common stock issuable upon conversion of 128 shares of Series A Convertible Preferred Stock (“Series A Preferred Stock”) held by BVF, (ii) 1,378,809 shares of common stock beneficially owned by Biotechnology Value Fund II, L.P. (“BVF2”), including 104,000 shares of common stock issuable upon conversion of 104 shares of Series A Preferred Stock held by BVF2, (iii) 191,242 shares of common stock beneficially owned by Biotechnology Value Trading Fund OS LP (“Trading Fund OS”), including 18,000 shares of common stock issuable upon conversion of 18 shares of Series A Preferred Stock held by Trading Funds OS, and (iv) 63,292 shares of common stock held through certain Partners managed accounts (the “Partners Managed Accounts”). BVF Partners OS Ltd. (“Partners OS”), as the general partner of Trading Fund OS, may be deemed to beneficially own the shares of common stock beneficially owned by Trading Fund OS. BVF Partners, L.P. (“Partners”) as the general partner of BVF, BVF2, the investment manager of Trading Fund OS, and the sole member of Partners OS, may be deemed to beneficially own the shares of common stock beneficially owned in the aggregate by BVF, BVF2, Trading Fund OS, and the Partners Managed Accounts. BVF Inc., as the general partner of Partners, may be deemed to beneficially own the shares of Common Stock owned by Partners. Mark N. Lampert, as a director and officer of BVF Inc., may be deemed to beneficially own the shares of Common Stock beneficially owned by BVF Inc. The foregoing excludes (i) 168,508 shares of common stock issuable upon the exercise of warrants held by BVF, (ii) 108,536 shares of common stock issuable upon the exercise of warrants held by BVF2, (iii) 30,190 shares of common stock issuable upon the exercise of warrants held by Trading Funds OS, and (iv) 54,830 additional shares of common stock issuable upon the exercise of warrants held by the Partners Managed Accounts, due to a beneficial ownership limitation. The shares of Series A Preferred Stock are only convertible to the extent that the holder, together with its affiliates and any other person or entity acting as a group, would not beneficially own more than 9.99% of the outstanding shares of common |

| 8 | Molecular Templates, Inc. | 2022 Proxy Statement |

Security Ownership of Certain Beneficial Owners and Management

| stock after giving effect to such conversion, as such percentage ownership is determined in accordance with the terms and provisions of the Company’s Certificate of Designation of Preferences, Rights and Limitations of Series A Convertible Preferred Stock. The warrants referenced above have an exercise price of $6.8423 per share and expire on August 1, 2024, but are only exercisable to the extent that the holder, together with its affiliates and any other person or entity acting as a group, would not beneficially own more than 4.99% of the outstanding shares of common stock after giving effect to such exercise, as such percentage ownership is determined in accordance with the terms of the warrants. Partners OS disclaims beneficial ownership of the shares of common stock beneficially owned by Trading Fund OS. Each of Partners, BVF Inc. and Mr. Lampert disclaims beneficial ownership of the shares of common stock beneficially owned by BVF, BVF2, Trading Fund OS, and the Partners Managed Accounts. |

| (5) | This information is based solely on a Schedule 13G filed with the SEC on February 10, 2022. Consists of 3,301,019 shares of common stock held by Pictet Asset Management SA. |

| (6) | Consists of (i) 243,459 shares of common stock held by Dr. Poma and (ii) 1,587,498 shares of our common stock issuable upon the exercise of options to purchase common stock held by Dr. Poma exercisable within 60 days of April 7, 2022. |

| (7) | Consists of (i) 83,404 shares of our common stock and (ii) 652,881 shares of our common stock issuable upon the exercise of options to purchase common stock held by Mr. Kim exercisable within 60 days of April 7, 2022. |

| (8) | Consists of 248,749 shares of common stock issuable upon exercise of options to purchase common stock held by Dr. Waltzman exercisable within 60 days of April 7, 2022. |

| (9) | Shares reported as beneficially owned by Dr. Hirsch consists of (i) 3,199,035 shares of common stock held directly by Longitude Venture III, (ii) 1,448,267 shares of common stock issuable upon exercise of warrants held by Longitude Venture Partners III, and (iii) 85,000 shares of our common stock issuable upon the exercise of options to purchase common stock held by Dr. Hirsch exercisable within 60 days of April 7, 2022. Dr. Hirsch is a member of Longitude Capital Partners III, LLC, the general partner of Longitude Venture Partners III, and therefore may be eld directly by Longitude Venture III. Dr. Hirsch disclaims beneficial ownership of the securities held by Longitude Venture III except to the extent of his pecuniary interest therein. |

| (10) | Consists of 93,635 shares of our common stock issuable upon the exercise of options to purchase common stock held by Mr. Hoffmann exercisable within 60 days of April 7, 2022. |

| (11) | Shares reported as beneficially owned by Mr. Lalande include (i) 864,665 shares of common stock held by Santé Health Ventures I Annex Fund, L.P., (ii) 4,827 shares of common stock issuable upon exercise of warrants held by Santé Health Ventures I Annex Fund, L.P., (iii) 6,097,298 shares of common stock held by Santé Health Ventures I, L.P., (iv) 19,310 shares of common stock issuable upon exercise of warrants held by Santé Health Ventures I, L.P., (v) 50,000 shares of common stock held by SHV Management Services, L.P. and (vi) 85,000 shares of our common stock issuable upon the exercise of options to purchase common stock held by Mr. Lalande exercisable within 60 days of April 7, 2022. The securities held by Santé Health Ventures I, L.P. and Santé Health Ventures I Annex Fund, L.P. may be deemed to be beneficially owned by Mr. Lalande, who is a managing director of SHV Management Services, LLC, which is the general partner of SHV Management Services, LP, which is the general partner of Santé Health Ventures I, L.P., and SHV Annex Services, LP, which is the general partner of Santé Health Ventures I Annex Fund, L.P. As a managing director of SHV Management Services, LLC, Mr. Lalande may be deemed to share voting and investment power over these securities held by Santé Health Ventures I, L.P. and Santé Health Ventures I Annex Fund, L.P. Mr. Lalande disclaims beneficial ownership of these securities except to the extent of his pecuniary interest therein. |

| (12) | Consists of 15,000 shares of our common stock issuable upon the exercise of options to purchase common stock held by Mr. Lanfear exercisable within 60 days of April 7, 2022. |

| (13) | Shares reported as beneficially owned by Mr. Morenstein include (i) 2,052,991 shares of common stock held by CDK Associates L.L.C. (“CDK”), (ii) a warrant to purchase 232,000 shares of common stock held by CDK, and (iii) 85,000 shares of common stock issuable upon the exercise of options to purchase common stock held by Mr. Morenstein exercisable within 60 days of April 7, 2022. Mr. Morenstein, a director of the Company, is a Managing Director of Caxton Alternative Management LP, the investment manager of CDK. Mr. Morenstein disclaims beneficial ownership of these securities except to the extent of his pecuniary interest therein. Caxton Corporation, Bruce Kovner and CDK Associates, L.L.C. may be considered directors by deputization due to their affiliation with Scott Morenstein. Each person disclaims beneficial ownership of these shares except to the extent of its or his pecuniary interest, if any, therein. The ownership of shares of common stock by CDK is subject to a 4.99% ownership blocker, pursuant to which shares of common stock may not be issued pursuant to the warrant, to the extent such issuance would cause CDK to beneficially own more than 4.99% of our outstanding common stock. The share ownership numbers and percentages for Mr. Morenstein in the table above reflect this 4.99% blocker. |

| (14) | Consists of 55,000 shares of our common stock issuable upon the exercise of options to purchase common stock held by Dr. Sanders exercisable within 60 days of April 7, 2022. |

| (15) | Consists of (i) 40,806 shares of our common stock held by Dr. Selick and (ii) 85,000 shares of our common stock issuable upon the exercise of options to purchase common stock within 60 days of April 7, 2022. |

| (16) | See footnotes (6) through (15) above. |

| Molecular Templates, Inc. | 2022 Proxy Statement | 9 |

Board of Directors, Management and Corporate Governance

Our certificate of incorporation, as amended and restated, provides that our business is to be managed by or under the direction of a classified board of directors. This means our board of directors (our “Board” or “Board of Directors”) is divided into three classes for purposes of election, with each class having as nearly as possible an equal number of directors. One class is elected at each annual meeting of stockholders to serve for a three-year term. The term of service of each class of directors is staggered so that the term of one class expires at each annual meeting of stockholders.

Our Board currently consists of nine (9) members, classified into three classes as follows:

| • | Class I is comprised of Eric E. Poma, Ph.D., Harold E. Selick, Ph.D. and Gabriela Gruia, M.D., with a term ending at the 2023 annual meeting of stockholders; |

| • | Class II is comprised of Jonathan Lanfear, Scott Morenstein and Corsee Sanders, Ph.D, with a term ending at the 2024 annual meeting of stockholders; and |

| • | Class III is comprised of David Hirsch, M.D., Ph.D., David R. Hoffmann and Kevin Lalande, with a term ending at the 2022 annual meeting of stockholders. |

Our certificate of incorporation and bylaws, each as amended and restated, provide that the authorized number of directors may be changed only by resolution of a majority of the Board of Directors. The Board of Directors makes an effort to distribute additional directorships resulting from an increase in the number of directors among the three classes so that, as nearly as possible, each class will consist of one-third of the directors. The division of our Board of Directors into three classes with staggered three-year terms may delay or prevent a change of our management or a change in control of our Company. Our directors may be removed only for cause by the affirmative vote of the holders of at least two-thirds of our outstanding voting stock entitled to vote in the election of directors. Any vacancy on our Board of Directors, including a vacancy resulting from an enlargement of our Board of Directors, may be filled only by the vote of a majority of our directors then in office.

| In selecting Board members, our Board may consider many factors, such as personal and professional integrity; ethics and values; experience in corporate management, such as serving as an officer or former officer of a publicly held company; experience as a Board member or executive officer of another publicly held company; diversity of expertise and experience in substantive matters pertaining to our business relative to other Board members; and diversity of background and perspective, including, but not limited to, with respect to age, gender, race, place of residence and specialized experience.

|

Director Ages

|

On March 9, 2022 our Board accepted the recommendation of the Nominating and Corporate Governance Committee and voted to nominate David Hirsch, M.D., Ph.D., David R. Hoffmann and Kevin Lalande, for election at the annual meeting for a term of three years to serve until the 2025 annual meeting of stockholders, and until their respective successors have been elected and qualified. The non-management directors of the Board are therefore recommending David Hirsch, M.D., Ph.D., David R. Hoffmann and Kevin Lalande for stockholders’ consideration in this proxy statement.

| 10 | Molecular Templates, Inc. | 2022 Proxy Statement |

Board of Directors, Management and Corporate Governance

Set forth below are the names of the persons nominated for election as directors and directors whose terms do not expire this year, their ages, their offices in the Company, if any, their principal occupations or employment for at least the past five years, the length of their tenure as directors and the names of other public companies in which such persons hold or have held directorships during the past five years. Additionally, information about the specific experience, qualifications, attributes or skills that led to our Board’s conclusion at the time of filing of this proxy statement that each person listed below should serve as a director is set forth below:

| Name |

Age | Position with the Company | ||||

| Eric E. Poma, Ph.D. |

50 | Chief Executive Officer and Chief Scientific Officer, Director | ||||

| Harold E. Selick, Ph.D.(2)(3) |

67 | Chairman of the Board | ||||

| David Hirsch, M.D., Ph.D.(1)(3) |

51 | Director | ||||

| David R. Hoffmann(1) |

77 | Director | ||||

| Kevin Lalande(2) |

49 | Director | ||||

| Jonathan Lanfear(1) |

53 | Director | ||||

| Scott Morenstein(1) |

46 | Director | ||||

| Corsee Sanders, Ph.D.(2) |

65 | Director | ||||

| Gabriela Gruia, M.D.(3) |

65 | Director | ||||

| (1) | Member of the Audit Committee |

| (2) | Member of the Compensation Committee |

| (3) | Member of the Nominating and Corporate Governance Committee |

Nominees for Class III Directors

Class III Directors

|

David Hirsch, M.D., Ph.D.

Director

Age: 51 Director Since: 2017 Board Committees: Audit, Nominating and Corporate Governance

|

Qualifications:

Our Board has concluded that Dr. Hirsch should serve as a director of the Company based on Dr. Hirsch’s perspective and experience as an investor and board member in the life sciences industry, as well as his strong medical and scientific background.

| |

| Biographical Information:

Dr. Hirsch has been a director of the Company since August 2017, effective as of the Merger. Since 2006, Dr. Hirsch has served as a Founder and Managing Director at Longitude Capital, where he focuses on investments in biotechnology. Dr. Hirsch currently serves as interim Chief Executive Officer and as a director of Alpha 9 Theranostics, Inc. Dr. Hirsch currently serves on the board of directors of Tricida, Inc. (TCDA), Poseida Therapeutics, Inc. (PSTX) and Rapid Micro Biosystems, Inc. In addition, Dr. Hirsch has previously served on the board of Collegium Pharmaceutical, Inc. (COLL), Amunix Pharmaceuticals, Inc., and a number of private companies. Dr. Hirsch holds a Ph.D. in Biology from the Massachusetts Institute of Technology, an M.D. from Harvard Medical School and a B.A. in Biology from Johns Hopkins University. | ||

|

David R. Hoffmann

Director

Age: 77 Director Since: 2017 Board Committees: Audit

|

Qualifications:

Our Board has determined that Mr. Hoffmann qualifies as an “audit committee financial expert” as defined by the rules of the SEC. Our Board has concluded that Mr. Hoffmann should serve as a director of the Company based on Mr. Hoffmann’s financial expertise and industry experience.

| |

| Biographical Information:

Mr. Hoffmann has been a director of the Company since August 2017, effective as of the Merger, and served as a Pre-Merger director of Threshold since April 2007. Since 2002, Mr. Hoffmann has served as the Chief Executive Officer of Hoffmann Associates, a multi-group company specializing in cruise travel and financial and benefit consulting. He serves as Chairman of the board of directors of DURECT Corporation. Mr. Hoffmann holds a B.S. in Business Administration from the University of Colorado. | ||

| Molecular Templates, Inc. | 2022 Proxy Statement | 11 |

Board of Directors, Management and Corporate Governance

|

Kevin Lalande

Director

Age: 49 Director Since: 2017 Board Committees: Compensation

|

Qualifications:

Our Board has concluded that Mr. Lalande should serve as a director of the Company based on his substantial experience as a venture capitalist and as a director of a number of privately-held and public companies.

| |

| Biographical Information:

Mr. Lalande has been a director of the Company since August 2017, effective as of the Merger. Mr. Lalande served on the board of directors of Private Molecular since 2009. Mr. Lalande is the Managing Member of SHV Management Services, LLC, a multi-strategy investment partnership with over $900 million in capital under management. Mr. Lalande currently serves as a director for a number of privately-held companies as well as Lumos Pharma, a publicly-traded biotechnology company, and previously served as a director for LDR Holding Corporation, now Zimmer Biomet, a publicly-traded medical device company. Mr. Lalande holds a B.S. in Electrical and Computer Engineering from Brigham Young University, an M.B.A. with Highest Distinction from the Harvard Business School, and a graduate certificate in Artificial Intelligence from Stanford University. | ||

Directors Continuing in Office

Class I Directors

|

Eric E. Poma, Ph.D.

Chief Executive Officer and Chief Scientific Officer, Director

Age: 50 Director Since: 2017 Board Committees: None

|

Qualifications:

Our Board has concluded that Dr. Poma should serve as a director of the Company based on Dr. Poma’s direct involvement in the creation of, and knowledge of, our technology platform and extensive experience in the industry, which provides invaluable insight to our Board on matters involving the Company and its future goals. Additionally, having the Chief Executive Officer as a director is an optimal way, in the Company’s opinion, of ensuring the most efficient execution and development of the Company’s business goals and strategies.

| |

| Biographical Information:

Dr. Poma has been a director of the Company since August 2017, effective as of the Merger. Dr. Poma is the Chief Executive Officer and Chief Scientific Officer of the Company and founded Private Molecular in February 2009, serving on its board of directors since its inception. From March 2005 until September 2008, Dr. Poma was Vice President of Business Development of Innovive Pharmaceuticals (acquired by Cytrx Corporation), a biotechnology company. As the founder of Private Molecular and in his role as Chief Scientific Officer, he led the invention of technology underlying the Company’s platform technology and what constitutes the whole of the Company’s current lead and preclinical pipeline candidates. Dr. Poma received his Ph.D. in Microbiology and Immunology and B.S. in Biology from the University of North Carolina at Chapel Hill and his M.B.A. from New York University. | ||

|

Harold E. “Barry” Selick, Ph.D.

Chairman of the Board

Age: 67 Director Since: 2017 Board Committees: Compensation, Nominating and Corporate Governance

|

Qualifications:

Our Board has concluded that Dr. Selick should serve as a director of the Company based on Dr. Selick’s extensive experience and industry knowledge. In addition, Dr. Selick brings an understanding of our Company and business, previously serving as Pre-Merger Threshold’s Chief Executive Officer.

| |

| Biographical Information:

Dr. Selick is chairman of the Company’s Board and has served as a director of the Company since August 2017, effective as of the Merger, and served as a Pre-Merger director of Threshold since June 2002. He is currently the Vice Chancellor of Business Development, Innovation and Partnerships at the University of California, San Francisco, a position that he has held since April 2017. Previously, Dr. Selick served as Pre-Merger Threshold’s Chief Executive Officer from June 2002 until March 2017. Dr. Selick previously served as director of Amunix Pharmaceuticals, lead director and chairman of PDL Biopharma, chairman of the board of directors of Catalyst Biosciences and currently serves as chairman of the board of Protagonist Therapeutics, the latter two of which are currently public drug discovery and development companies. Dr. Selick received his B.A. in Biophysics and Ph.D. in Biology from the University of Pennsylvania and was a Damon Runyon-Walter Winchell Cancer Fund Fellow and an American Cancer Society Senior Fellow at the University of California, San Francisco. | ||

| 12 | Molecular Templates, Inc. | 2022 Proxy Statement |

Board of Directors, Management and Corporate Governance

|

Gabriela Gruia, M.D.

Director

Age: 65 Director Since: 2022 Board Committees: Nominating and Corporate Governance

|

Qualifications:

Our Board has concluded that Dr. Gruia should serve as a director of the Company because of her perspective and experience as a board member in the life sciences industry, as well as her strong medical, regulatory and scientific background, specifically in oncology and oncology drug development.

| |

| Biographical Information:

Dr. Gruia has been a director of the Company since 2022. Dr. Gruia is an oncologist with over 25 years of experience in oncology drug development, spanning cell and gene therapy, bi-specifics, biologics, immunotherapy, and small molecules and currently serves as the Founder and Principal of Gabriela Gruia Consulting, LLC. From February 2020 to January 2021, Dr. Gruia served as Chief Development Officer at Ichnos Sciences, where she oversaw development activities for several key functions, including Clinical Development and Clinical Operations, Regulatory Sciences, Clinical Pharmacology, Toxicology, and Biostatistics. From August 2004 to February 2020, Dr. Gruia was Senior Vice President and Global Head of Regulatory Affairs for Novartis Oncology, where she led the world class oncology regulatory affairs organization and oversaw all regulatory activities in close partnership with research collaborators, preclinical development, development organization and senior management. While at Novartis, Dr. Gruia spearheaded the worldwide submission and approval of multiple new molecular entities, including Tasigna®, Jakavi®, Afinitor®, Signifor®, Zykadia®, Farydak®, Rydapt®, Odomzo®, Kisqali®, Kymriah®, Adakveo®, and Piqray®. Dr. Gruia serves as a member of the board of directors of TSCAN Therapeutics and Tessa Therapeutics Ltd. Dr. Gruia earned a doctorate in medicine from Bucharest Medical School in Romania and a Masters in Breast Pathology and Mammography from the Rene Huguenin/Curie Institute Cancer Center in Paris, France. She completed training in oncology and hematology at Rene Descartes University in Paris, France. | ||

Class II Directors

|

Jonathan Lanfear

Director

Age: 53 Director Since: 2018 Board Committees: Audit

|

Qualifications:

Our Board has concluded that Mr. Lanfear should serve as a director of the Company based on Mr. Lanfear’s industry perspective and experience developed through his leadership roles with Takeda Pharmaceuticals as well as his industry consulting experience.

| |

| Biographical Information:

Mr. Lanfear has been a director of the Company since May 2018. Mr. Lanfear is currently Principal at Lanfear Advisors LLC, providing business development, corporate strategy and operational consulting to public and private sector biotech and biopharmaceutical companies. Additionally, Mr. Lanfear is currently the Chief Operating Officer of HiberCell, Inc. From December 2011 to September 2020, Mr. Lanfear was employed by Takeda Pharmaceuticals where he was Vice President and Global Head of R&D Business Development. Mr. Lanfear holds a B.S. in Chemical Engineering and a Master’s degree in Bioengineering, both from the University of Michigan (Ann Arbor), and an M.B.A. from Washington University (St. Louis). Mr. Lanfear previously served on the board of directors of Aquinnah Pharmaceuticals, a privately-held neurodegeneration-focused company and ARTham Therapeutics, Inc., a privately held clinical stage biopharmaceutical company focused on medicines that satisfy significant unmet medical need. | ||

| Molecular Templates, Inc. | 2022 Proxy Statement | 13 |

Board of Directors, Management and Corporate Governance

|

Scott Morenstein

Director

Age: 46 Director Since: 2017 Board Committees: Audit

|

Qualifications:

Our Board has concluded that Mr. Morenstein should serve as a director of the Company based on Mr. Morenstein’s industry and financial expertise as developed through his significant experience in biopharmaceutical investing, equity research and investment banking.

| |

| Biographical Information:

Mr. Morenstein has been a director of the Company since August 2017, effective as of the Merger. Mr. Morenstein serves as Managing Director of Blackstone since February 2022. From November 2013 to February 2022, Mr. Morenstein served as Managing Director of CAM Capital, where he led healthcare investing. Prior to joining CAM Capital in November 2013, Mr. Morenstein served as Managing Director at Valence Life Sciences from January 2012 to November 2013 and before that Principal at Caxton Advantage Venture Partners, which he joined in August 2007. Mr. Morenstein has more than 15 years’ experience in biopharmaceutical investing, equity research and investment banking. Previously, he served as a director of Synta Pharmaceuticals to advise the company as it explored strategic alternatives ultimately leading to a merger with Madrigal Pharmaceuticals. He served as a member of the board of directors of Gemin X Pharmaceuticals until its acquisition by Cephalon and previously served as a director of Celator Pharmaceuticals and Velicept Therapeutics. He currently serves as a director of Primmune Therapeutics, Palvella Therapeutics, Avenge Bio, and Antios Therapeutics and as a board observer for a number of public and private companies. Mr. Morenstein received an M.B.A. from Harvard Business School and a B.A. from the University of Pennsylvania with a degree in the Biological Basis of Behavior with a Concentration in the Physiology of Neural Systems. | ||

|

Corsee Sanders, Ph.D.

Director

Age: 65 Director Since: 2019 Board Committees: Compensation

|

Qualifications:

Our Board has concluded that Dr. Sanders should serve as a director of the Company based on Dr. Sanders’s extensive background in pharmaceutical operations as well as her scientific and leadership experience.

| |

| Biographical Information:

Dr. Sanders has been a director of the Company since December 2019. From November 2019 to February 2020, Dr. Sanders served as a Strategic Advisor to the Global Development Group of Bristol Myers Squibb. Previously, Dr. Sanders served as Strategic Advisor to the Office of the Celgene Chief Medical Officer, since March 2018 to November 2019, ensuring effective integration of Juno Therapeutics’ Development Organization into the Celgene Organization, specifically the unique CAR T aspects, advising the label-enabling CAR T legacy Juno program (JCAR017), and advising the Chief Medical Officer and the Chief Medical Officer’s leadership team in evolving the clinical development organization. From January 2017 to March 2018, Dr. Sanders was a Member of the Juno Therapeutics Executive Committee as Head of Strategic and Development Operations, with responsibilities for strategic operations, quantitative sciences, biosample and clinical operations. Dr. Sanders was a Member of the Genentech/Roche Late-Stage Portfolio Committee from 2011 to 2017, and Global Head of the Genentech/Roche Late Stage Clinical Operations from 2012 to 2017, with responsibility for leading nearly 2,500 employees, across 5 strategic and 20 local country sites, in planning and conducting global development and local clinical trials in over 70 countries. Dr. Sanders has directly contributed and/or provided oversight in developing multiple approved pharmaceutical products including Claritin®, Rituxan®, Herceptin®, TNKase®, Cathflo®, Xolair, Avastin®, Tarceva®, Lucentis®, Zelboraf®, Perjeta®, Erivedge®, Gazyva®, Kadcyla®, Alecensa®, Cotellic®, Venclexta®, Tecentriq®, Ocrevus®, Hemlibra®, and JCAR017®, a CAR T cell therapy for NHL. She currently serves as a member of the Board of Trustees for the Fred Hutchinson Cancer Research Center. Dr. Sanders currently serves as a director for biopharmaceutical companies, such as Ultragenyx Pharmaceuticals, Inc., Beigene, Ltd., AltruBio Inc. and Legend Biotech Corporation. Dr. Sanders earned her B.S. and M.S. in statistics, graduating Magna Cum Laude from the University of the Philippines, and her M.A. and Ph.D. in statistics from the Wharton Doctoral Program at the University of Pennsylvania. | ||

| 14 | Molecular Templates, Inc. | 2022 Proxy Statement |

Board of Directors, Management and Corporate Governance

Rule 5605 of the Nasdaq Listing Rules requires a majority of a listed company’s board of directors to be comprised of independent directors. In addition, the Nasdaq Listing Rules require that, subject to specified exceptions, each member of a listed company’s audit, compensation, and nominating and corporate governance committees be independent under the Securities and Exchange Act of 1934, as amended (the “Exchange Act”). Under Rule 5605(a)(2), a director will only qualify as an “independent director” if, in the opinion of our Board of Directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Audit committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Exchange Act. In order to be considered independent for purposes of Rule 10A-3, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the board of directors, or any other board committee: (1) accept, directly or indirectly, any consulting, advisory, or other compensatory fee from the listed company or any of its subsidiaries; or (2) be an affiliated person of the listed company or any of its subsidiaries.

Compensation committee members must also satisfy the independence criteria set forth in Rule 10C-1 under the Exchange Act. In order to be considered independent for purposes of Rule 10C-1, a board must consider, for each member of a compensation committee of a listed company, all factors specifically relevant to determining whether a director has a relationship to such company which is material to that director’s ability to be independent from management in connection with the duties of a compensation committee member, including, but not limited to: the source of compensation of the director, including any consulting advisory or other compensatory fee paid by such company to the director; and whether the director is affiliated with the company or any of its subsidiaries or affiliates.

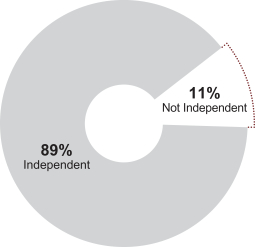

Our Board has reviewed the composition of our Board and its committees and the independence of each director. Based upon information requested from and provided by each director concerning his or her background, employment and affiliations, including family relationships, our Board of Directors has determined that each of our directors, with the exception of Eric E. Poma, is an “independent director” as defined under Rule 5606(a)(2) of the Nasdaq Listing Rules. As such, our Board of Directors determined that each of David Hirsch, M.D., Ph.D., David R. Hoffmann, Kevin Lalande, Gabriela Gruia, M.D., Jonathan Lanfear, Scott Morenstein, Harold “Barry” Selick, Ph.D., and Corsee Sanders, Ph.D. are independent. Our Board of Directors determined that David R. Hoffmann, David Hirsch, M.D., Ph.D., Jonathan Lanfear, and Scott Morenstein, who comprise our Audit Committee, Harold “Barry” Selick, Ph.D., Gabriela Gruia, M.D., and David Hirsch, M.D., Ph.D. who comprise our Nominating and Corporate Governance Committee and Kevin Lalande, Corsee Sanders, Ph.D., and Harold “Barry” Selick, Ph.D., who comprise our Compensation Committee, satisfy the independence standards for such committees established by the SEC and the Nasdaq Listing Rules, as applicable. In making such determinations, our Board of Directors considered the relationships that each such non-employee director has with our Company and all other facts and circumstances our Board of Directors deemed relevant in determining independence, including the beneficial ownership of our capital stock by each non-employee director.

Director Independence

| Molecular Templates, Inc. | 2022 Proxy Statement | 15 |

Board of Directors, Management and Corporate Governance

Committees of the Board of Directors and Meetings

| Board Members |

Audit | Compensation | Nominating

and Corporate Governance | |||

| Harold E. “Barry” Selick, Ph.D. |

🌑 | p | ||||

| Jonathan Lanfear |

🌑 | |||||

| David Hirsch, M.D., Ph.D. |

🌑 | 🌑 | ||||

| David R. Hoffmann |

p | |||||

| Kevin Lalande |

p | |||||

| Scott Morenstein |

🌑 | |||||

| Eric E. Poma, Ph.D. |

||||||

| Corsee Sanders, Ph.D. |

🌑 | |||||

| Gabriela Gruia, M.D. |

🌑 |

p Chair 🌑 Member

During the fiscal year ended December 31, 2021, there were six meetings of our Board, and the various committees of the Board met a total of nine times. None of our directors attended fewer than 75% of the total number of meetings of the Board and of committees of the Board on which he or she served during fiscal 2021. The Board has adopted a policy under which each member of the Board is strongly encouraged to attend each annual meeting of our stockholders. Five of our directors attended our annual meeting of stockholders held in 2021.

We have established an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. Each of these committees operates under a charter that has been approved by our Board of Directors and satisfies the applicable rules and regulations of the SEC and the applicable listing standards of Nasdaq. Members will serve on these committees until their resignation or as otherwise determined by our Board of Directors.

Audit Committee. Our Audit Committee met five times during fiscal year 2021. This committee currently has four members, David R. Hoffmann (Chairman), David Hirsch, M.D., Ph.D., Scott Morenstein, and Jonathan Lanfear. All members of the Audit Committee satisfy the current independence standards promulgated by the SEC and by the listing standards of Nasdaq as such standards apply specifically to members of audit committees. The Board has determined that Mr. Hoffmann is an “audit committee financial expert,” as the SEC has defined that term in Item 407 of Regulation S-K. Please also see the report of the Audit Committee set forth elsewhere in this proxy statement. Our Audit Committee’s role and responsibilities are set forth in the Audit Committee’s written charter and include, among others:

| • | appointing, evaluating, retaining, overseeing, and if need be, terminating the engagement of any independent auditor; |

| • | assessing the qualification, performance and independence of our independent auditor; |

| • | pre-approving all audit and non-audit services to be performed by our independent auditor; |

| • | reviewing our financial statements and related disclosures; |

| • | reviewing the adequacy and effectiveness of our accounting and financial reporting processes, systems of internal control and disclosure controls and procedures; |

| • | reviewing our overall risk management framework; |

| • | overseeing procedures for the treatment of complaints on accounting, internal accounting controls, or audit matters; |

| • | reviewing and discussing with management and the independent auditor the results of our annual audit, reviews of our quarterly financial statements and our publicly filed reports; |

| • | reviewing and approving related person transactions; and |

| • | preparing the audit committee report that the SEC requires in our annual proxy statement. |

A copy of the Audit Committee’s written charter is publicly available on our website at www.mtem.com.

Please also see the Report of Audit Committee set forth elsewhere in this proxy statement.

| 16 | Molecular Templates, Inc. | 2022 Proxy Statement |

Board of Directors, Management and Corporate Governance

Compensation Committee. Our Compensation Committee met three times during fiscal year 2021. This committee currently has three members, Kevin Lalande (Chairman), Corsee Sanders, Ph.D. and Harold “Barry” Selick, Ph.D. All members of the Compensation Committee qualify as independent under the definition promulgated by the listing standards of Nasdaq. Our Compensation Committee’s role and responsibilities are set forth in the Compensation Committee’s written charter and include:

| • | reviewing, approving and making recommendations regarding our compensation policies, practices and procedures to ensure that legal and fiduciary responsibilities of the Board are carried out and that such policies, practices and procedures contribute to our success; |

| • | appointing, evaluating, retaining, overseeing, and if need be, terminating the engagement of any compensation consultant; |

| • | evaluating and administering our equity-based plans and awards granted under such plans, including our 2018 Equity Incentive Plan, 2014 Equity Incentive Plan, as amended, our 2009 Stock Plan, as amended, our 2004 Amended and Restated Equity Incentive Plan, as amended, and our Amended and Restated 2004 Employee Stock Purchase Plan; |

| • | reviewing the elements and amount of total compensation for all executive officers and reviewing and approving any changes in such compensation; |

| • | reviewing and making recommendations to our Board of Directors regarding director compensation; and |

| • | reviewing and approving, or recommending to our Board of Directors for approval, the compensation of our chief executive officer, conducting this decision making process without the chief executive officer present. |

In establishing compensation amounts for executives, the Compensation Committee seeks to provide compensation that is competitive in light of current market conditions and industry practices. Accordingly, the Compensation Committee will generally review market data which is comprised of proxy-disclosed data from peer companies and information from nationally recognized published surveys for the biopharmaceutical industry. The market data helps the Compensation Committee gain perspective on the compensation levels and practices at peer companies and to assess the relative competitiveness of the compensation paid to the Company’s executives. The market data thus guides the Compensation Committee in its efforts to set executive compensation levels and program targets at competitive levels for comparable roles in the marketplace. The Compensation Committee then considers other factors, such as the importance of each executive officer’s role to the Company, individual expertise, experience, and performance, retention concerns and relevant compensation trends in the marketplace, in making its final compensation determinations.

As noted above, the Compensation Committee has the authority to directly retain the services of independent consultants and other experts to assist in fulfilling its responsibilities. The Compensation Committee has engaged the services of Haigh & Company, a national executive compensation consulting firm, to review and provide recommendations concerning all of the components of the Company’s executive compensation program. Haigh & Company performs services solely on behalf of the Compensation Committee and has no relationship with the Company or management except as it may relate to performing such services. Haigh & Company assists the Compensation Committee in defining the appropriate market of the Company’s peer companies for executive compensation and practices and in benchmarking our executive compensation program against the peer group each year. Haigh & Company also assists the Compensation Committee in benchmarking our director compensation program and practices against those of our peers.